ohio sales tax exemption form 2019

Farmers have been exempt from Ohio sales tax on purchases used for agricultural production for several decades. The Ohio Department of Taxation provides a searchable repository of individual tax forms for multiple purposes.

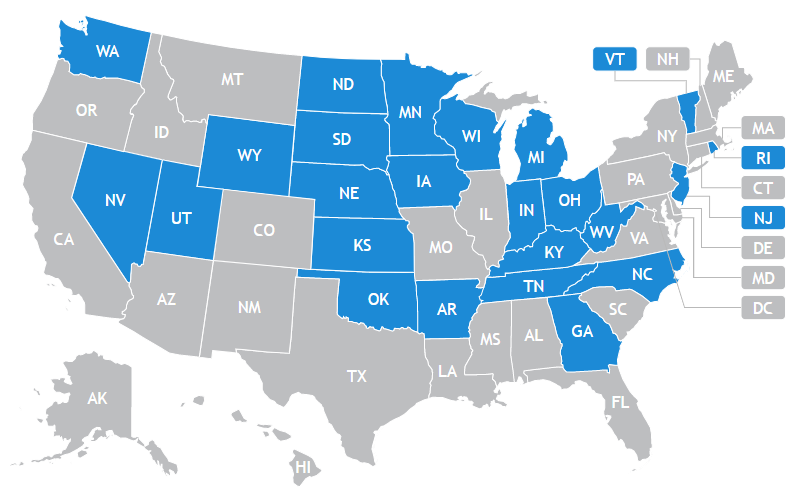

2019 State Individual Income Tax Rates And Brackets Tax Foundation

Exemption From Ohio State Sales Tax Non Profit Form.

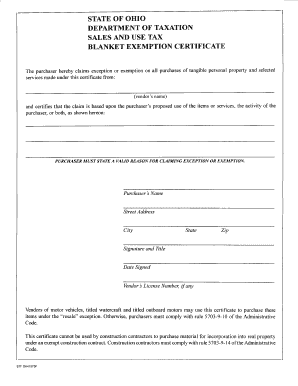

. Construction contractors must comply with rule 5703-9-14 of the. Sign Online button or tick the preview image of the blank. Construction contractors must comply with Administrative Code Rule 5703-9-14.

1 John Carroll Blvd. However this does not make all purchases by farmers exempt. Real property under an exempt construction contract.

You can use the Blanket Exemption. Most forms are available for download and some can be filled or. 2019 Fuel Advance Credit Repayment.

2019 Sales Use and Withholding Taxes Amended Annual Return. Enter a full or partial form number or. Thats because Ohios sales tax law is a bit tedious and complicated.

Sales and Use Tax Unit Exemption Certifi cate. Thankfully there are many sales tax exemption. For other Ohio sales tax exemption certificates go here.

Sales and Use Tax Blanket Exemption Certificate. In Ohio certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Sales Tax Exemptions in Ohio.

The law has several agricultural exemptions but it can be challenging to understand who can claim them. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. A 501c3 non-profit company is normally exempt from.

To get started on the form utilize the Fill camp. Sales tax exemption in the state applies to. 2019 Sales Use and Withholding Taxes Annual Return.

You can download a PDF of the Ohio Blanket Exemption Certificate Form STEC-B on this page. Types of sales tax exemptions available in Ohio. SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE.

The way to complete the Ohio sales tax certificatesignNowcom form on the web. Questions should be directed preferable in. Click here for specific instructions regarding opening and using any of our pdf fill-in forms if you are a Windows 10 user.

By COLUMBUS CITY CODES Chapter 3712e and Tax Regulations of the Franklin County Convention Facilities Authority Section 2d. Der an exempt construction contract. Sales tax is a significant expense for businesses that sell goods and services.

Purchaser must state a valid reason for claiming exception or exemption John Carroll University. Sales income tax will not be relevant to no-profit businesses. In transactions where sales.

Fill Free Fillable Forms State Of Ohio

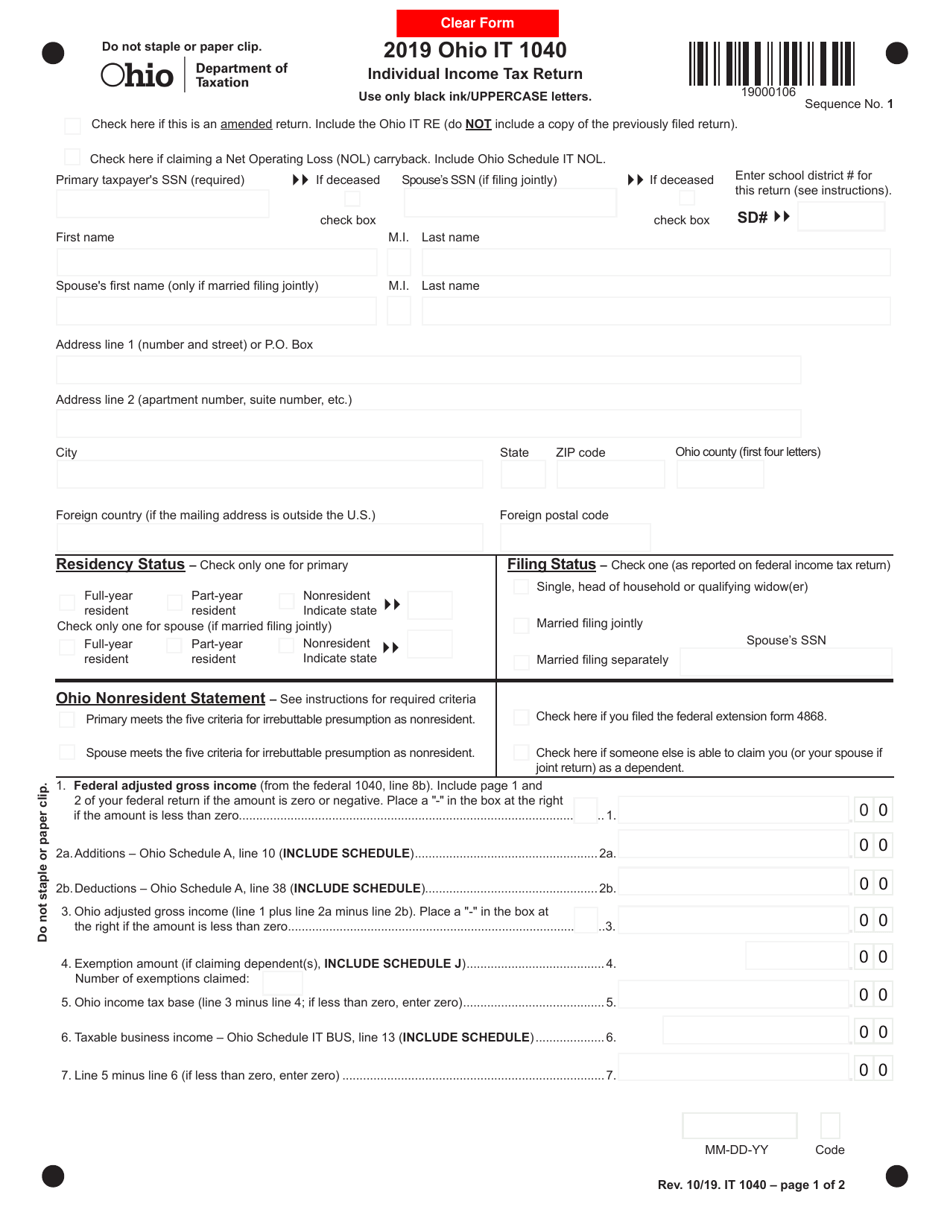

Form It1040 Download Fillable Pdf Or Fill Online Individual Income Tax Return 2019 Ohio Templateroller

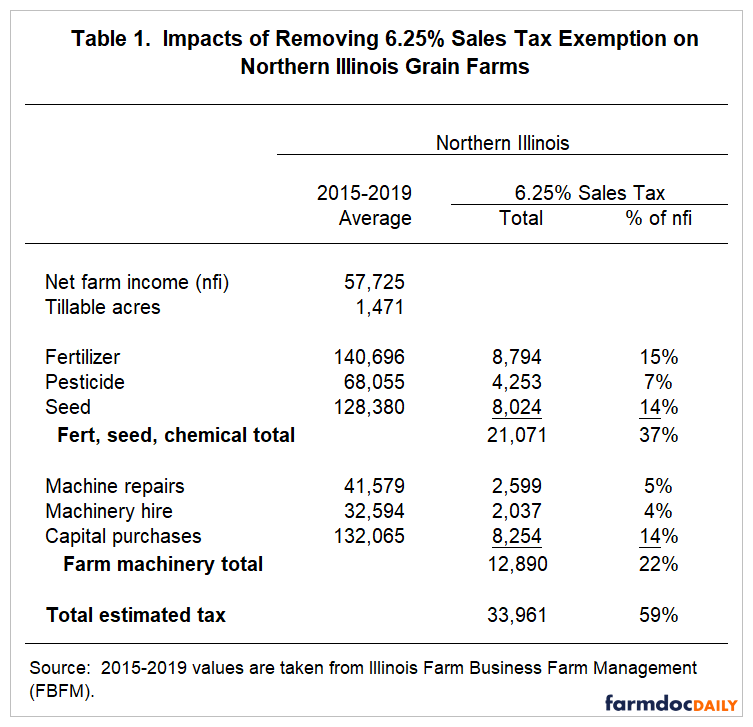

Impacts Of Removal Of Illinois Sales Tax Exemptions On Illinois Grain Farms Farmdoc Daily

More Generation Now Dark Money Traced To Aep In Ohio Corruption Scandal

The Four Corners Standard Exemptax Blog

Ohio Oh State Tax Refund Ohio Tax Brackets Taxact Blog

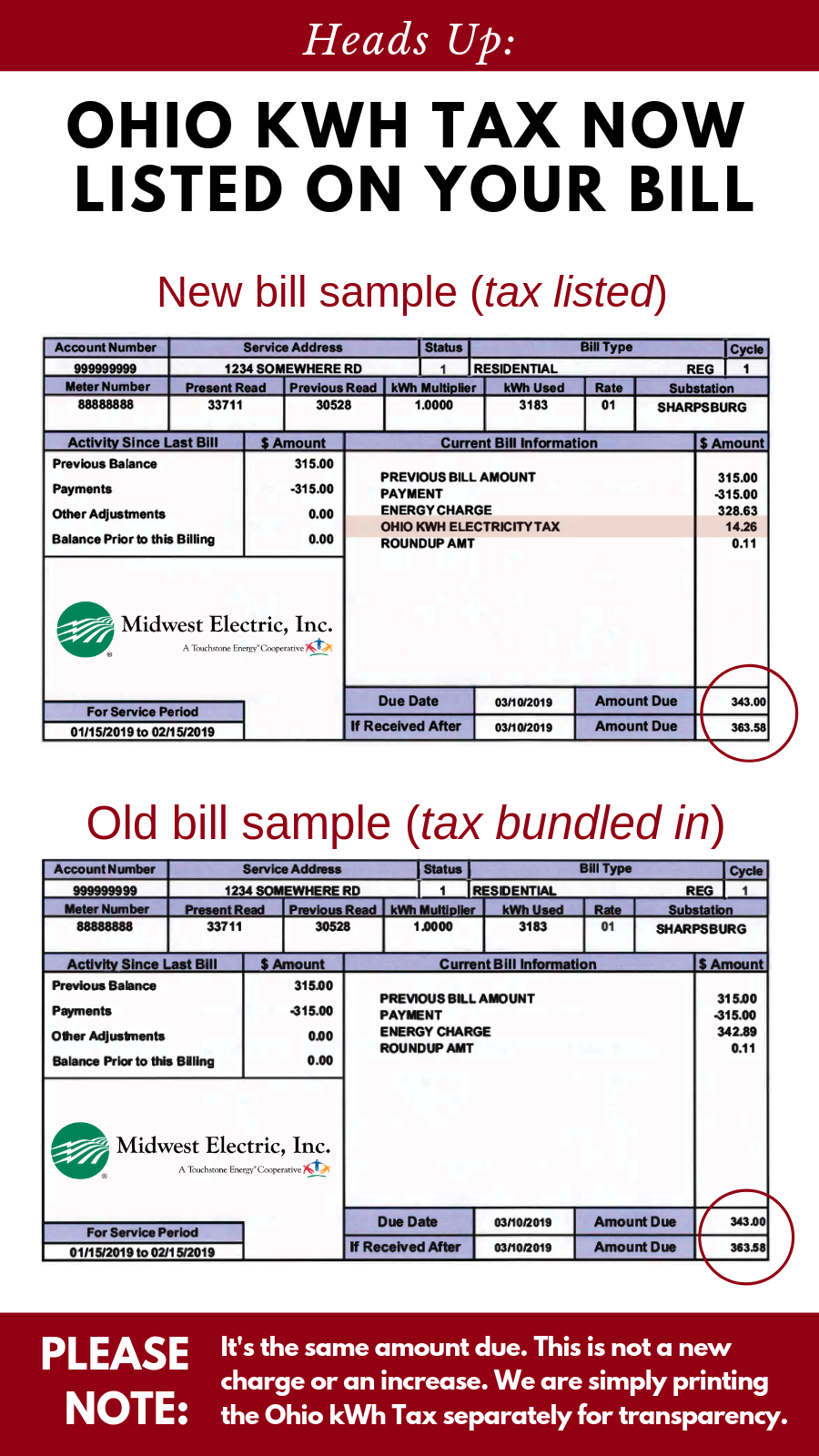

Ohio S Kwh Tax The Lowdown On This Hidden Electricity Tax Midwest Electric Inc

Impacts Of Removal Of Illinois Sales Tax Exemptions On Illinois Grain Farms Farmdoc Daily

2015 2022 Oh Stec B Formerly Stf Oh41575f Fill Online Printable Fillable Blank Pdffiller

Ohio Taxation Ohiotaxation Twitter

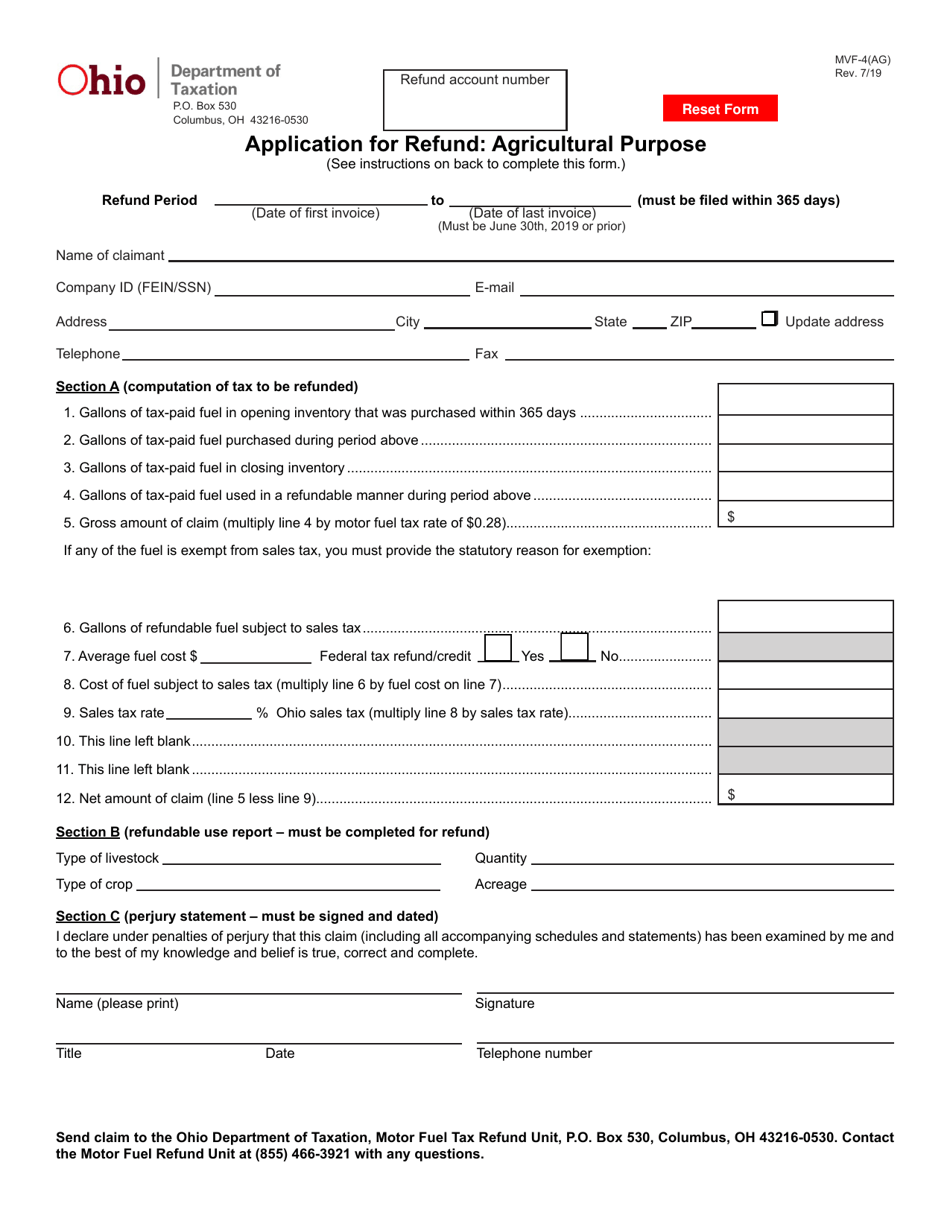

Form Mvf 4 Ag Download Fillable Pdf Or Fill Online Application For Refund Agricultural Purpose Ohio Templateroller

Ohio Sales Tax Exemption For Manufacturing Agile Consulting

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Printable Ohio Sales Tax Exemption Certificates

Ohio Tax Rates Things To Know Credit Karma

Local Income Taxes In 2019 Local Income Tax City County Level

Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow